Supporting the University’s Mission

The UConn Foundation is pleased to raise, manage, and administer endowed funds in support of the University’s mission. As we embark on a historic $1.5 billion campaign for UConn, our donors’ investments put students first while also elevating faculty, groundbreaking research, sustainability, and a thriving community on campus that fuels the state. The UConn Foundation and the University thank you for your ongoing support.

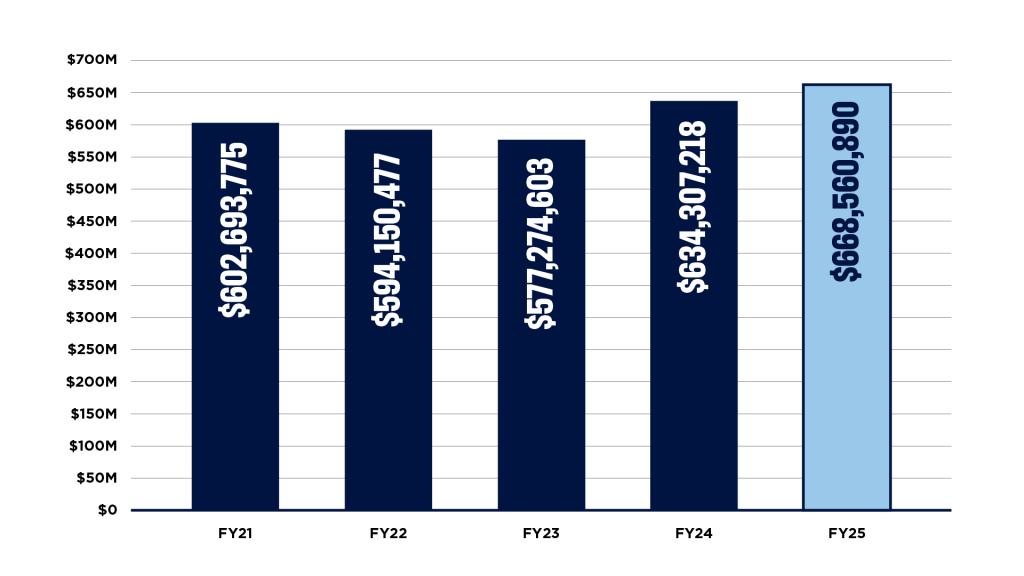

The UConn Foundation Endowment

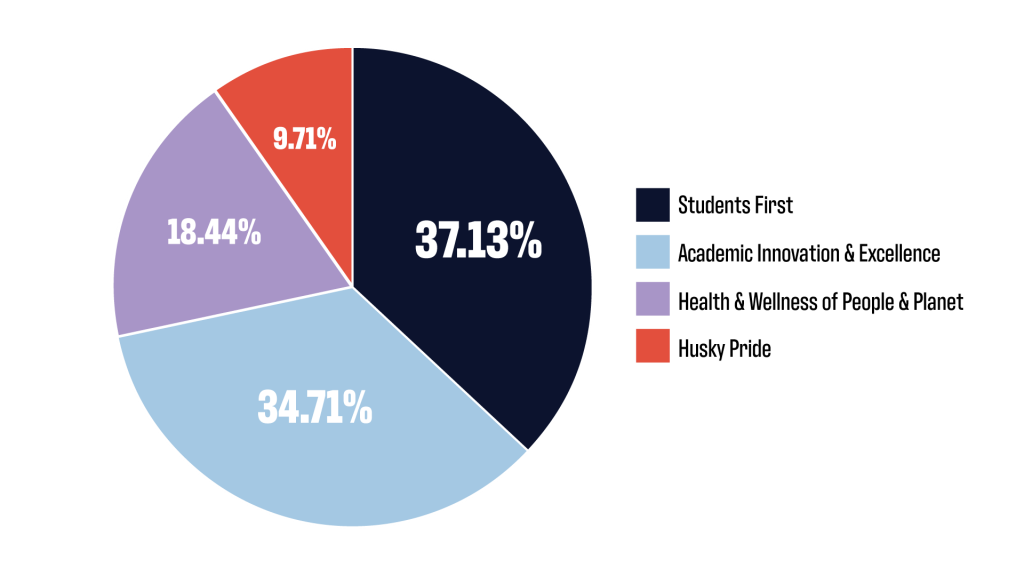

Academic & Innovation Excellence

$231,299,728

Driving investment in top faculty, students, and the innovation and research ecosystem that fuels Connecticut and the world.

Health & Wellness of People & Planet

$123,216,038

Focusing on patient care, medical research, and the development of life-changing technologies that improve healthcare outcomes and create a sustainable future.

Students First

$249,573,211

Creating opportunities for transformative education through scholarships, wellness and life skills, and academic success for every student.

Husky Pride

$64,471,913

Investing in athletic excellence and engaging a thriving UConn Nation of more than 290,000 alumni worldwide.

Current Total Endowment Value – Primary Campaign Pillars

Investment Performance

Trailing Returns Through 12/31/25

Investment Portfolio Composition

Asset Class

(as of December 31, 2025)

Region

Sector

Endowment FAQ

The Role of the Endowment

An endowment is a fund where donor gifts are invested to generate a stream of investment returns to support a particular University purpose in perpetuity. The investments of numerous individual endowment funds are pooled together for the purpose of efficiency, consistency, and economies of scale. The Foundation endowment pool is known formally as the Long-Term Endowment Investment Portfolio but is colloquially referred to as “the Endowment”.

Each endowment’s investment income is distributed to support its intended purpose, while the donated principal remains in place permanently and invested to keep pace with the rate of inflation. Endowments are important to the University because they provide a stable and ongoing source of funding to support its students, faculty, and community.

The endowment’s market value is targeted to grow to over $1 billion under our recently-launched Because of UConn capital campaign. The endowment is young relative to our peers, about half the age of most peers and close to a century younger than some. For this reason, we have had half the time for fundraising and half the time of compounding of investment returns. Despite our relative age, the endowment size was recently ranked 71st among 239 public universities and is targeted to grow to over $1 billion under our recently-launched Because of UConn capital campaign.

While investment returns are expected to produce nominal growth at or above the rate of inflation, real (inflation-adjusted) growth occurs through active philanthropic fundraising by a professional team of dedicated Huskies in partnership with University leaders, Deans and faculty.

The UConn Foundation is governed by a Board of Directors that includes independent directors (largely UConn alumni) as well as ex-officio members including the UConn President and other University officials. A Master Agreement between the University and the Foundation details each party’s roles and responsibilities, and each year a Statement of Work (SOW) is prepared to define the goals, objectives and financial considerations. The Foundation Board bylaws, the Master Agreement, and the SOW can be found on our Governance and Disclosure page.

The Foundation is required to provide audited financial statements annually to the University, the State of Connecticut, and other parties. Grant Thornton LLC currently provides this audit as well as the Foundation’s annual Form 990 tax returns, both of which can be found on our Financial Information page.

Endowment Administration

A minimum gift of $50,000 is generally required to establish an endowment. Higher minimums may apply depending on the nature of the fund and its purpose. For example, lower minimums are generally required to fund scholarships than faculty positions. Multi-year pledges may be made to create an endowment, provided that they are fully funded within five years. Pledge payments are held by the Foundation outside of the endowment pool and invested in accordance with our Non-Endowed Assets Investment Policy until such time as the cumulative funding exceeds $50,000. Once this threshold is met, all amounts are transferred into the endowment pool on the first day of the next quarter.

The funds allocated for expenditure for the donor(s)’ designated purpose (the “Spending Allocation”) are paid quarterly, at an amount equal to 1% (or approximately 4% per year) of the rolling prior 12-quarter average of the fund’s market value. These distributions begin once the endowed fund has participated in the pooled investment portfolio for two calendar quarters. In the event that the total endowment expenditures including fees is less than 3% or greater than 6.5% of the current market value of the full endowment pool, then the Spending Allocation will be proportionally increased or decreased such that the total expenditures are increased to 3% or reduced to 6.5% accordingly. For further information please refer to our Policy on Expenditures from Endowed Funds.

The Spending Allocation is assessed quarterly based on the endowment’s rolling 12-quarter average market value, which is intended to keep it relatively stable as investment returns fluctuate from quarter to quarter. Nevertheless, Spending Allocations will vary as market conditions change. Over longer periods, our investment objective is to generate returns such that the distributions will grow at approximately the rate of inflation.

In periods of significant market declines, the market value of an individual endowment may fall below the original dollar amount of gifts to the fund (i.e. becomes “underwater”). Unless the University signatory who is authorized to oversee the fund elects to pause the spending allocation, distributions will continue unless and until the fund becomes more than 15% underwater. At that point, all distributions will be paused and reevaluated each quarter and may resume when the fund is no longer greater than 15% underwater.

The Foundation or the University signatory may determine to pause a fund’s spending distributions at times when it becomes challenging or impractical to spend them for their designated purpose, or when there are significant amounts remaining unspent from prior years’ distributions (more than 10% of its market value). This allows the paused distributions to remain invested in the endowment pool, but unspent amounts from prior years’ distributions may continue to be utilized.

Like other University foundations across the country, the UConn Foundation assesses a small percentage of the market value of each endowment (the “Advancement Fee”) to support continued fundraising and development, donor cultivation and stewardship, and ongoing support of our advancement mission. Currently this fee is 1.75% per year, assessed quarterly based on the endowment’s rolling 12-quarter average market value. (For additional detail please see our Policy on Expenditures from Endowed Funds.) This fee should not be confused with an investment management fee for managing the endowment. In fact, only a small portion of this fee is used for endowment management and administration.

Most peer institutions assess a similar fee, which is higher for some and lower for others. Several factors contribute to these differences, including the size of the endowment; whether or not an institution charges a separate one-time fee on new gifts to its endowment (which the UConn Foundation does not); and the institution’s internal operating model. For example at UConn, the entire advancement function sits within the Foundation, while at many other institutions it sits within their college or university.

Investment Management

In managing the endowment pool, the Foundation seeks to provide investment returns which, when measured over long time periods, are sufficient to provide a steady level of distributions to support the intended University recipients while preserving its real (inflation-adjusted) purchasing power in perpetuity. Inflation is defined by the Consumer Price Index for All Urban Consumers (CPI-U).

The Foundation engages outside advisors in both public and private markets who act as independent resources for the Foundation Investments staff and its Investment Committee (“IC”). The Foundation Board of Directors has entrusted the fiduciary responsibility for management and investment of the Endowment to the IC, subject to the requirements of Board-approved investment policies. The IC is comprised of UConn alumni with both public and private markets experience in a diverse range of roles from portfolio managers to executives and administrators. Read more about the Foundation’s investment process and governance model.

The Foundation invests in a broad spectrum of both public and private assets across the globe through commingled funds managed by third parties alongside other investors. These include public and private equity, fixed income, public and private credit, real estate, infrastructure, real assets, and other asset classes. The mix of assets is designed to optimize the overall return, inter-period volatility, and liquidity to meet the endowment’s objective of providing stable, intergenerational distributions to support the donors’ intended purposes. Additional details can be found in our investment policy statement.

Investment ideas originate with the Foundation’s public and private market advisors, who act as independent resources for the Foundation staff and Investment Committee (“IC”). These ideas are then vetted by the Foundation’s staff, who work closely with the external advisors to assess risk and alignment with the Foundation’s overall portfolio strategy. This is followed by a review and due diligence from a working group of the IC, which includes both staff and advisors, before a full vote by the IC. This structured, multi-step process ensures that every investment decision is thoroughly evaluated, minimizing risk and maximizing alignment with the Foundation’s long-term goals. Read more about the Foundation’s investment process and governance model.

Performance and risk are measured relative to two primary benchmarks per the Foundation’s investment policy statement:

- A blended index comprised of 70% global stocks (MSCI All Country World Index) and 30% global bonds (Bloomberg Global Aggregate Index). This is a passive index, measuring how the endowment pool may have hypothetically performed had it been simply invested passively in public securities across the globe rather than actively managed.

- A more granular benchmark which measures the performance of all of the actual underlying asset classes (public and private) specified in the policy, weighted by their existing allocations. This benchmark is meant to capture the excess return produced by our third-party asset managers, independent of asset allocation decisions.

It is important to note that these benchmarks are intended to measure performance over long time periods (through a full business cycle) and are less useful measures over shorter periods. In addition, they are intended to measure both risk and returns, and so underperformance or outperformance against a benchmark should be taken in context of whether the investment profile has been riskier or less risky than the benchmarks.

The UConn Foundation follows best practices in considering Environmental, Social and Governance (ESG) factors alongside the other prudent investment management considerations required both in our contract with the University and under Connecticut statute. Our directive to consider ESG factors is prescribed in our investment policy statement. Unlike many of our larger peers, the Foundation does not hold stock in any individual companies but instead invests in commingled funds managed by third parties alongside other investors.